2. Serious property. “Dwelling” signifies a household structure which contains 1 to 4 units, whether the construction is attached to authentic residence. See

Such as, In case the contract specifies that fee adjustments are depending on the index value in influence forty five times ahead of the adjust day, the creditor may possibly use any index benefit in effect in the course of the forty five times in advance of consummation in calculating the totally indexed fee.

1. Forward commitments. A creditor may well produce a property finance loan loan which will be transferred or marketed into a purchaser pursuant to an settlement that has been entered into at or before the time the transaction is consummated. Such an settlement is sometimes referred to as a “forward determination.” A balloon-payment mortgage which will be acquired by a purchaser pursuant into a forward motivation will not satisfy the requirements of § 1026.43(file)(1)(v), whether the ahead commitment provides for the acquisition and sale of the specific transaction or for the acquisition and sale of transactions with selected prescribed standards the transaction meets. Nevertheless, a purchase and sale of a balloon-payment skilled home finance loan to another person who individually meets the requirements of § 1026.

(ii) Yet another man or woman, Should the transaction provided by one other individual incorporates a reduced desire rate or possibly a decreased complete dollar level of origination low cost factors and details or charges.

(5) Loan sum signifies the principal amount the consumer will borrow as mirrored inside the promissory Be aware or loan deal.

Any additional draw in opposition to the road of credit score the creditor of your included transaction won't know or have reason to find out about before or during underwriting need not be viewed as in relation to ability to repay. One example is, the place the creditor's procedures and strategies involve the supply of deposit to become verified, and also the creditor verifies that a simultaneous loan that is a HELOC will offer the supply of deposit for the first-lien included transaction, the creditor should think about the periodic payment about the HELOC by assuming the amount drawn is not less than the deposit amount. Generally speaking, a creditor should establish the periodic payment dependant on assistance within the commentary to § 1026.forty(d)(five) (discussing payment terms).

Total curiosity payments: The amount of curiosity you shell out about the lifetime of the loan. This variety doesn’t incorporate the origination payment.

) Forgiven possibly incrementally or in entire, at a date particular, and matter only to specified ownership and occupancy conditions, like a requirement that The customer maintain the home as The buyer's principal dwelling for 5 years;

Card rankings may possibly fluctuate by classification as the identical card may perhaps receive a special rating dependant on that group. CreditSoup.com might be compensated by businesses stated on our web-site each time a client’s software is approved or approved by the corporation.

(2) Thoroughly amortizing payment indicates a periodic payment of principal and desire that will fully repay the loan total above the loan phrase.

iv. Presume that the subject property is a component of the homeowners Affiliation which includes imposed upon the seller a Specific assessment of $one,200. Think further more this Specific assessment will come to be The buyer's obligation on consummation on the transaction, that the consumer is permitted to pay the Distinctive assessment in twelve $one hundred installments following consummation, and the home loan loan will not be originated pursuant into a government software which contains particular prerequisites for prorating Particular assessments.

Borrowers with weak credit score may well qualify for a negative-credit rating individual loan, nonetheless, it is possible to help your read more probabilities of qualifying and minimize your fee by acquiring a joint, co-signed or secured personal loan.

two. The creditor used underwriting benchmarks that have historically resulted in comparatively low premiums of delinquency and default for the duration of adverse economic circumstances; or

(iv) The consumer has made no multiple payment much more than thirty times late within the non-common mortgage loan over the twelve months quickly previous the creditor's receipt of The customer's published software for that conventional property finance loan.

Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Danica McKellar Then & Now!

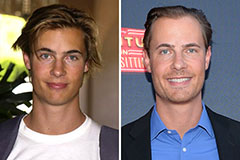

Danica McKellar Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!